(6) Confidence in Layers:

Updating MDNA11’s Valuation in the Composite Scoring Era

Cohort Clarification:

The cohorts referenced in this article reflect PRISM-11–defined stratifications based on composite biomarker logic (e.g., CD8/Treg ratios, TCR clonality, TLS status, EV burden, IFN-γ reactivation). While some cohort names differ from Medicenna’s formal terminology in the April 2025 corporate update, they map directly to tumor types and therapeutic categories Medicenna is actively investigating.

For example, “PDAC 2L” reflects a biomarker-enriched subset within their GI strategy; “NSCLC CPI-R” models checkpoint-refractory lung cancer. These labels allow for more granular NPV modeling while fully encompassing Medicenna’s disclosed indications—and in some cases, extending into PRISM-11–projected strata informed by translational science.

In addition, where cohort language overlaps with Beyond the Salvage Floor, this article reflects a refinement of those early confidence tiers—not a departure from them. The core assumptions behind tumor inclusion remain intact, while the re-weighting logic introduced here adds biological specificity and expands valuation fidelity. Composite logic doesn’t replace the original framework—it enhances it by better explaining why certain salvage cohorts are likely to respond and offering clearer, biomarker-driven rationale for where MDNA11 may gain approval faster or perform better.

From Tumor Type to Immune Topology

The original $2.69B valuation for MDNA11—outlined in Beyond the Salvage Floor—was built on a confidence-tiered model rooted in tumor type and line of therapy. It worked because it was simple. But simplicity was always a placeholder.

Now, composite biomarker scoring offers a better scaffold. Ma et al. (2024) make the case that response isn’t dictated by PD-L1 or TMB alone—but by multivariate immune conditions: EV burden, IL-6 levels, TLS structure, and CD8/Treg balance. These aren’t fringe variables—they’re fate determinants.

This article is about what that means for valuation. We’re not revising the TAM yet. But we are ready to layer in new logic: one that re-weights confidence not by histology—but by immune profile alignment with what MDNA11 is built to rewire.

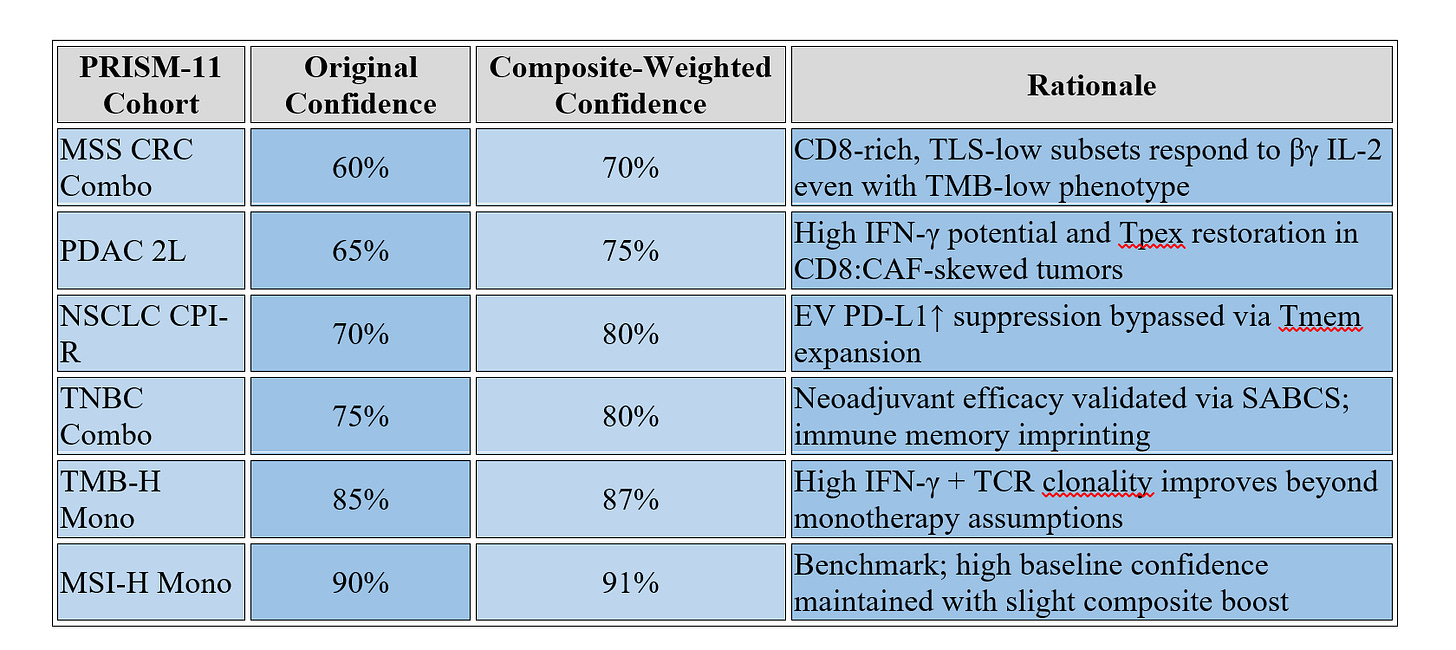

Composite-Weighted Confidence Tier Revisions

Below, we re-weight six core PRISM-11 cohorts using composite biomarker logic—highlighting where suppression profiles, structural disruption (e.g., TLS-low), and immune topology align with MDNA11's mechanism. The goal isn't to change the TAM, but to sharpen confidence-tier assumptions based on improved mechanistic understanding.

Assuming a weighted average uplift of ~10% across these cohorts, the model suggests an increase of up to $400–550M in floor NPV without altering pricing, market share, or patient population size. This supports a floor re-rate from $2.69B → $3.1–3.25B, driven solely by confidence-tier refinement.

Further modeling to follow in: Tier-Specific Uplift Table, Updated NPV Blend Ranges, and Strategic Weighting Scenarios.

Updated NPV Blend Ranges (Composite-Weighted vs Original)

As confidence tiers shift with composite stratification, so too does cohort-level NPV weighting. The following chart illustrates adjusted per-cohort valuations that account for biomarker-informed increases in modeled probability.

This cohort-level uplift contributes to the aggregate increase of ~$400–550M in modeled NPV, supporting the revised floor of $3.1–3.25B outlined above.

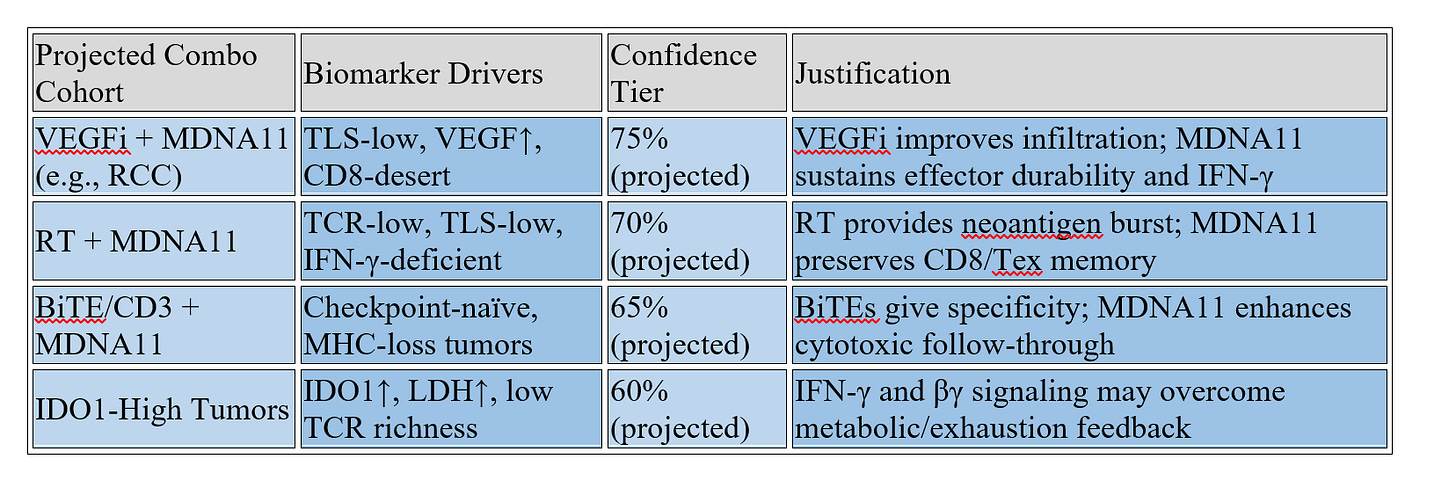

Strategic Additions: Biomarker-Justified Combination Cohorts

While the composite scoring approach has helped refine existing confidence tiers, it also opens the door for rational cohort expansion. Based on the intersection of biomarker failure modes and MDNA11’s reprogramming strengths, the following combination strategies warrant consideration:

These are PRISM-11–proposed expansions, not yet part of Medicenna’s formal roadmap. However, they align with mechanistic rationale and composite scoring profiles that indicate MDNA11 could produce differentiated responses in these contexts—particularly when combined with existing standard-of-care partners.

Conclusion: A More Confident Floor—And a Clearer Future

Composite scoring doesn’t just change how we diagnose response. It changes how we model confidence—and how we prioritize trial design. With new biomarker-aligned tiers, MDNA11's $2.69B valuation floor no longer rests on assumption. It rests on structure.

From EV suppression to TLS disarray, from IDO1 escape to IL-6 exhaustion—MDNA11 isn’t reacting to resistance. It’s built for it.

And when your model aligns with the way the immune system fails, confidence doesn’t just rise. It compounds.

References

Ma W, Wu Y, Liang S, et al. (2024). Advances in predictive biomarkers for melanoma immunotherapy: from single-point indicators to multidimensional models. Holistic Integrative Oncology, 3:48. https://doi.org/10.1007/s44178-024-00121-9

Yang M, Cui M, Sun Y, Liu S, Jiang W. (2024). Mechanisms, combination therapy, and biomarkers in cancer immunotherapy resistance. Cell Communication and Signaling, 22:338. https://doi.org/10.1186/s12964-024-01711-w

Medicenna Therapeutics. (2024). SABCS Presentation Slides: Neoadjuvant MDNA11 in Orthotopic TNBC Model.

https://medicenna.com

Addendum

3 new biomarkers that merit tier elevation or matrix integration in the next re-rank:

CXCL9/10 + FGFBP2⁺ memory T migration

PD-L2 (exosomal + CAF expression)

LY6A⁺ CD8⁺ stem-like T cells (LN-resident, IFNγ-activated)

These don’t change the original logic, but they sharpen stratification in cold tumors and explain LN durability seen in CRC and PDAC.