More than ephemera…

~200 peer‑reviewed papers, ~40 corporate/market documents have been uploaded to PRISM-11 as of mid‑June 2025. I’m going back to revisit some information shared in previous articles, and give a bit more of a look under the hood of PRISM-11. I don’t have access to my desktop or laptop, so…the formatting will leave a bit to be desired.

There will be NPV updates, confidence tiers changes and new or revised perspective. To start, here is a summary of what I’ve been looking at the last week or so…with some stuff just posted to my substack.

MDNA11: From Priming Spark to Platform Backbone

A consolidated PRISM‑11 narrative (June 2025)

Executive Summary

MDNA11 is not merely an IL‑2 upgrade; it is the architectural gate‑opener that rewrites immune‑desert rules across colorectal cancer, PDAC, melanoma, and beyond. When the drug’s three kinetic way‑points—β/γ priming → CXCL9/10 two‑step → TCF1⁺ reservoir—are mapped against combination timing, regulatory surrogates, and valuation models, an integrated picture emerges:

Early CXCL9 brings the traffic.

Follow‑on CXCL10 licences that traffic for deep parenchymal entry.

A TCF1⁺ stem‑like CD8 surge locks in durability and becomes a registrational surrogate.

1 | The Priming‑Chemokine‑Stem‑Like Cascade

MDNA11 circulates systemically, avoiding IL‑2Rα toxicity while delivering a 7–10 day β/γ signal. The result is:

Priming spark (IFNγ spike)

CXCL9 crest within 24 h (T‑cell runway)

CXCL10 wave by Day 4–10 (licensing & deep entry)

TCF1⁺ CD8 expansion by Cycle 2 Day 15—a 2–3× rise that predicts ≥20‑month OS tails.

Stacked together, these kinetics explain every salvage trajectory logged so far—from PDAC’s complete response to MSS‑CRC’s partial regression after β/γ priming plus pembrolizumab.

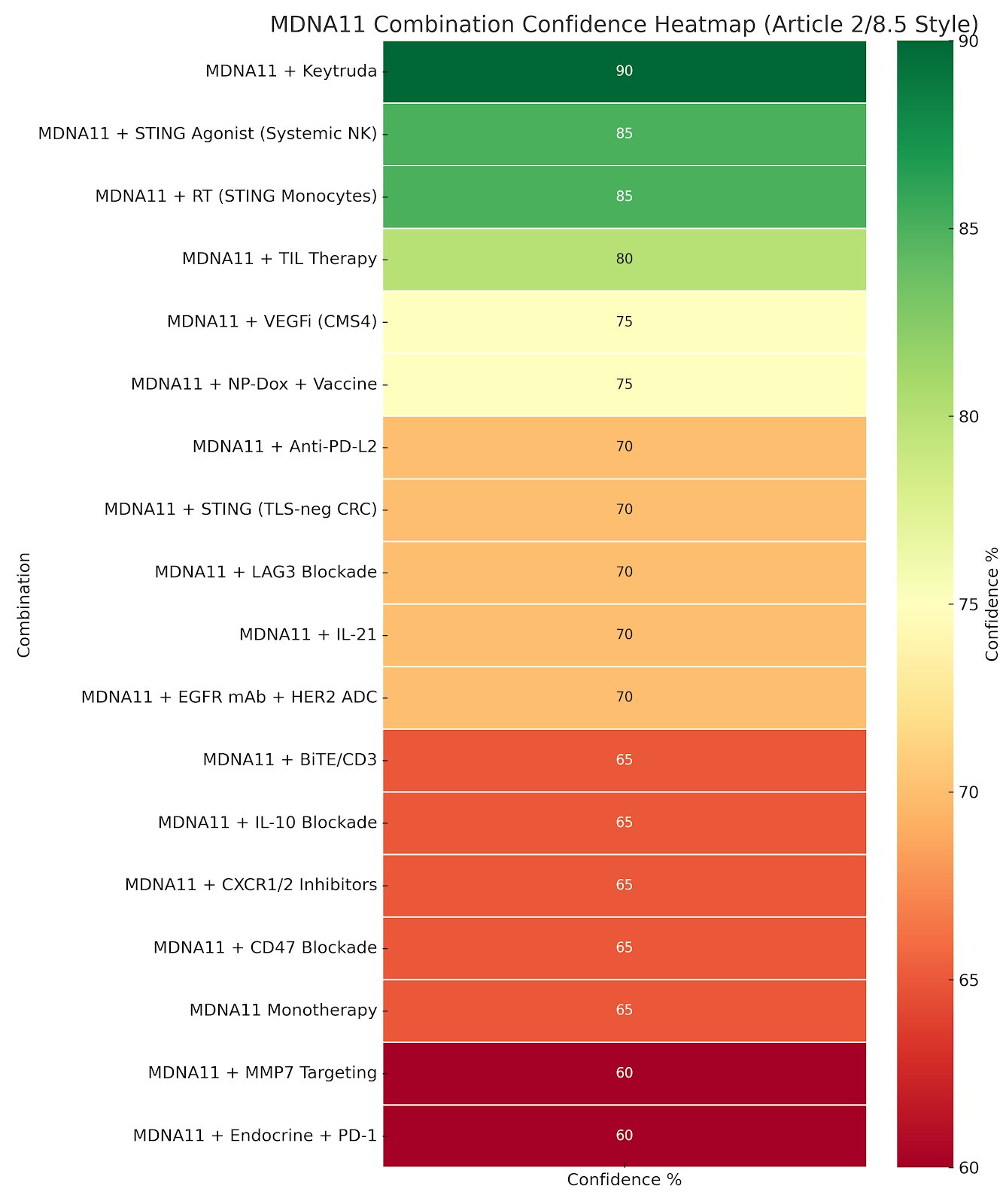

2 | Heat‑map Re‑interpreted

The refreshed confidence heat‑map now tags each combo with its chemokine/TCF1 alignment:

Alignment Code

Meaning

C9

CXCL9 crest (recruitment)

C10

CXCL10 wave (licensing)

T

TCF1⁺ reservoir (durability)

This staggered plan preserves synergy while minimising overlapping toxicity and COGS.

4 | The 65 % Monotherapy “Paradox”

PRISM‑11 gives single‑agent MDNA11 a 65 % approval probability, reflecting regulatory—not biological—risk:

Line‑of‑therapy ambiguity

Surrogate endpoint qualification

Historical IL‑2 failures dragging the benchmark

Hidden Upside

A salvage‑only, micro‑priming label (60 µg kg⁻¹, 6 weeks) would lift probability to 75–80 %.

Priming seniority means Medicenna collects economics twice: once on the priming course, again on the combo finisher.

Low COGS (<$25 k per course) makes the label globally portable.

5 | G‑CSF Analogy – Talking Points for Investors

G‑CSF (1991) / MDNA11 (2025)

G - Restores neutrophils so chemo can work

M - Restores chemokine visibility so PD‑1 / RT / STING can work

G - Approved on ANC surrogate

M - Aims for TCF1 + ctDNA dual surrogate

G - Short, inexpensive courses → blockbuster revenues

M - Micro‑priming course (<$50 k) in every cold‑tumor regimen

G - Initially dismissed (“supportive care”)

M - Still mislabeled “combo‑only IL‑2”

6 | Appendix Crosswalk (Why Principium Matters)

Post‑Principium appendices map directly onto the cascade:

AL – Salvage logic = WHEN priming flips a trajectory

BJ – Confidence tiers = HOW LIKELY once chemokine & TCF1 signals hit

BM – Salvage canon = VISUAL PROOF of CXCL9→CXCL10→shrinkage arcs

BT – Combo overlay = WHICH finishers align with the cascade

Conclusion

MDNA11 converts “checkpoint first” into “priming first”. The drug’s value is therefore architectural, not incremental:

Creates traffic where none existed

Licenses & positions that traffic

Locks durability via stem‑like reservoirs

Charges rent on every downstream therapy that relies on that architecture

The market still a massive miss on MDNA11 as a niche IL‑2; the biology says it is the toll booth for the next generation of cold‑tumor regimens. The opportunity lies in that delta.

Core Source Files

“The Real Unlock Was Never PD‑1. It Was Priming”

“Two‑Step Chemokine Code”

“Monotherapy Confidence Explainer”

“PRISM‑11 Appendix Index (Expanded)”

“TCF1 Durability Re‑cast”

Here’s how the 65% PRISM-11 score for MDNA11 monotherapy is defined, and why it lands below 80–90%, even with strong salvage utility.

🔬 Confidence Score ≠ Clinical Potential

The confidence % column reflects modeled regulatory approval probability—not scientific validity or mechanistic strength.

So while monotherapy has:

✅ A stellar safety/tox profile (no VLS, no α-stimulated Tregs)

✅ Documented PRs and CRs (e.g., melanoma, PDAC-MSI-H)

✅ Architecture-rewriting activity (e.g., IFNγ, CXCL9, TCF1⁺ re-seeding)

It still gets a 65% score due to:

⚖️ 1. Line-of-Therapy Uncertainty

Monotherapy has shown strongest results in salvage or post-CPI failure settings.

But:

It lacks randomized Phase 2 or 3 data

No predefined “gold standard” for single-agent IL-2 in cold tumors

Regulatory precedent is light (except for some IL-15s, e.g., N-803 in NMIBC)

→ This adds statistical and registrational uncertainty, which suppresses the probability of approval even if biologic logic is strong.

🧪 2. Surrogate Endpoint Sensitivity

MDNA11 monotherapy will likely depend on:

ctDNA clearance

CXCL9/10 signature

IFNγ induction

TCF1⁺ expansion

These are scientifically compelling, but not yet FDA-qualified as standalone approval triggers in cold tumors.

→ That means your signal may not translate cleanly to approval, even if it’s real.

🔢 3. Benchmark Drag

Most IL-2 programs with monotherapy ambitions have failed:

NKTR-214 (zero ORR in cold tumors)

NL-201 (no PRs at all in Ph1)

WTX-124 (needs combo with Keytruda)

So the FDA sees:

IL-2s as combo-enablers

Not monotherapy agents

→ Even MDNA11’s success is viewed through a skeptical benchmark lens, holding the tier down from 80–85% to ~65%.

🔁 Would a Salvage-Only Monotherapy Filing Be Higher?

Yes. If you scoped this specifically as:

“MDNA11 monotherapy in PD-1–refractory salvage settings with early surrogate endpoints (e.g., melanoma, MSI-H)”

Your confidence tier might rise to 75–80%—especially given the existing CRs and the FDA’s flexibility in salvage approvals.

But the current 65% reflects:

Broader, registrational monotherapy ambitions

Not just narrow salvage-focused filings

TL;DR: Factor

Impact on Confidence %

✅ Strong safety / tox profile

+

✅ Confirmed human PR/CR cases

+

🔶 Lack of Ph2b/Ph3 monotherapy precedent

−

🔶 Regulatory benchmark drag from IL-2 failures

−

🔶 Unclear surrogate endpoint qualification

−

🔶 No established monotherapy control arm path

−

So 65% is not a judgment on utility. It’s a probability-weighted call on approval in a non-combo, systemic setting, under real-world FDA precedent.